Ultimate VC and Angel Investor List For Startups 2023

Enjoy a few pitch tips below or skip straight to investor list.

Key takeaways from this blog

- Learn the essentials of crafting a compelling pitch to investors, including how to effectively communicate your business idea and financial projections to secure funding. Discover strategies and techniques to make your pitch stand out and increase your chances of securing investment.

- Get to know about various tips and recommendations to enhance your chances of success. Discover strategies for staying organized, making informed decisions, and navigating common challenges in your field.

- In this blog, you’ll learn about the top investors, venture capital firms, angel investors, and accelerators in the industry.

- Discover a comprehensive list of large company investors who are actively seeking investment opportunities. Explore the investment portfolios and areas of focus for these companies, as well as tips and recommendations for approaching them with your business idea.

- Learn how to grow website revenue with Leadbright LOOP, a cutting-edge AI solution for lead generation. Discover how Leadbright’s LOOP can help you streamline your lead generation process, increase conversion rates, and grow your business.

How to pitch to investors

First relax, be yourself.

When preparing to pitch to investors, it’s important to make sure you have everything ready in the appropriate amount of time.

This includes having a well-prepared pitch deck and understanding the specific requirements of each investor.

It’s also important to avoid beginning your pitch with your ideal investor, as it can limit your opportunities for success.

Make the necessary preparations in the appropriate amount of time

Ensure timely preparation for a seamless pitch experience by making appropriate preparations within the given timeframe. Time management is crucial when it comes to investor pitching.

Prioritizing tasks and resource allocation are key elements that’ll help you get things done efficiently. Make sure you have all the necessary information, data, and resources before starting to prepare your pitch deck. Efficient planning can help reduce stress levels and ensure that deadlines are met.

One of the best ways to make timely preparations is by creating a plan or a checklist with specific goals and deadlines for each task. This way, you can keep track of your progress and prioritize tasks according to their importance.

Remember that investors are looking for companies that can demonstrate competence in managing their time effectively, so it’s important to show them that you’re able to do so right from the beginning of your pitch process. By prioritizing tasks effectively, allocating resources wisely, and meeting deadlines consistently, you’ll be able to create a strong first impression with potential investors.

Avoid beginning with your ideal investor

To ace your first pitch and close a transaction on the spot is a very uncommon occurrence. Often, it will take multiple rejections from investors before you eventually receive money.

The attitude to adopt in this situation is that you can learn something from every encounter with an investor, even from the rejections. You’ll pick up tips on presenting your business, and responding to typical inquiries. Especially what sorts of information investors are looking for from you.

With this in mind, starting with your ideal investor may only sometimes be a good idea. You may first improve your pitch and story by meeting four or five other investors. This will help you be much more prepared when you will meet the investor you most want to meet.

Recognize the requirements of various investors

Understanding the diverse demands of investors is crucial for attracting funding and building lasting relationships with those who share your vision. Investor preferences can vary greatly depending on their industry focus, investment stage, geographic location, and funding size.

It’s important to research potential investors thoroughly to understand their preferences and tailor your pitch accordingly. For example, some investors may only invest in certain industries or at specific stages of a company’s growth. Others may have a minimum or maximum investment size they’re willing to make.

Understanding these factors can help you identify which investors are the best fit for your business and increase your chances of securing funding. Additionally, taking the time to personalize your pitch based on an investor’s individual preferences shows that you value their time and attention, making it more likely that they’ll be interested in working with you in the long run.

How to approach investors?

When it comes to approaching investors, I believe in taking a strategic approach.

Firstly, it’s important to introduce yourself properly to Venture Capitalists and build relationships with them over time.

Secondly, making an Angel investor pitch requires careful preparation and understanding of what each individual investor is looking for.

Finally, performing due diligence on each potential investor is crucial to ensure that their investment interests align with your startup’s goals.

Introducing yourself to Venture Capitalists?

VCs are more meticulous, focused on the details, and interested in the metrics. They have a big responsibility to make wise choices because they are signing cheques on behalf of a group of investors. Concentrate on specifics, data, and potential hazards while pitching VCs.

To make an unforgettable impression on venture capitalists, you should introduce yourself in a way that highlights your unique qualities and experiences while also demonstrating your dedication to solving a pressing problem in the market.

Outline the problem you’re solving, explaining how your solution is different from existing alternatives, showcasing traction (such as user growth or revenue), and ending with a strong call-to-action.

Building rapport with venture capitalists is also key to introducing yourself successfully. You can do this by researching their past investments and finding common ground for conversation. Additionally, sharing personal anecdotes or experiences that demonstrate your passion for the problem you’re solving can help build trust and establish a connection.

Ultimately, introducing yourself effectively means highlighting your unique selling proposition, showcasing traction, managing expectations about what you hope to achieve with their investment, and building rapport through shared interests and personal stories.

How to make an Angel investor pitch?

High net-worth individuals that invest as angels are acting alone as investors. This implies that angels generally move more quickly. Focus more on the broad picture, the possible upside, and the sizable market your product covers while making an angel investor presentation.

If you want to make a lasting impression on an angel investor and convince them to invest in your startup, you’ll need to craft a compelling introduction. This introduction should showcase your unique qualities, address the problem you’re solving, and highlight your traction.

But before jumping into the pitch, it’s important to understand the angel investor mindset. Angels invest their own money into startups. They’re looking for opportunities to not only earn a return on their investment but also contribute to something meaningful and innovative.

Building rapport with an angel investor is crucial as it helps establish trust and credibility. Start by researching the investor’s background and previous investments. Find common ground or mutual interests that you can use to connect with them on a personal level.

When presenting financials, be transparent about your current revenue streams and projections for future growth. Highlighting traction is also key – demonstrate how your product or service has gained momentum in the marketplace through customer acquisition metrics or partnerships.

Lastly, address any potential risks or obstacles upfront and provide solutions for managing them effectively. By following these tips, you’ll increase your chances of securing funding from an angel investor who believes in both you and your vision.

Perform due diligence on each investor

Performing due diligence on each potential investor is like digging for treasure. You carefully examine their background and previous investments to find common ground and establish trust before presenting your startup’s unique qualities. It involves extensive investor research, understanding their investment criteria, and creating a due diligence checklist to ensure that the investor aligns with your company’s goals.

Investor communication is also essential in this process. Once you’ve identified a potential investor, it’s important to communicate effectively and efficiently. Building relationships with investors takes time, but maintaining open lines of communication can help establish trust and increase the chances of securing funding.

Finally, after completing your due diligence checklist and evaluating each potential investor thoroughly, you can make informed decisions about which investors are the best fit for your startup.

Do your homework on each investor you want to meet, looking for information like:

- Startups that they have previously funded

- What leads them to accept is (or not)

- The kind of inquiries they make

- A few phone calls to founders who have previously worked with that investor might be a wonderful place to start if you need help locating what you need from a quick Google search.

Pitch tips and recommendations

I want to share some tips and recommendations that’ve helped me successfully approach investors.

Firstly, it’s important to recognize the uncertainties surrounding fundraising – rejection is inevitable, so don’t let it discourage you.

Secondly, the pitch deck is crucial in conveying your business idea effectively – make sure it’s clear and concise with a strong value proposition.

Lastly, always be prepared for questions and feedback from investors – show that you’re receptive to their input and willing to adapt.

Recognize the uncertainties

Recognize the uncertainties and embrace them, as they’re the very challenges that’ll make your startup stronger and more resilient.

As an entrepreneur, it’s important to understand that risks come with every opportunity. The key’s to have a solid risk management plan in place and be willing to pivot when necessary. Being flexible in your approach allows for creative problem-solving and agility in decision making.

When pitching to investors, it’s important to acknowledge potential obstacles and demonstrate how you plan on addressing them. Investors want to see that you’ve thought through all possible scenarios and have a clear plan of action. Don’t try to hide or downplay any uncertainties; instead, use them as an opportunity to showcase your problem-solving skills and adaptability.

By embracing uncertainty, you show potential investors that you’re not just prepared for success but also equipped to handle any challenges that may arise along the way.

The PITCH deck

You need to create a pitch deck that showcases your startup’s potential and addresses any uncertainties, demonstrating to potential investors that you have a solid plan in place for success.

Pitch deck essentials include information about your product or service, the market opportunity, competition analysis, business model, financial projections, and team bios. Keep your pitch deck concise and visually appealing with impactful graphics and charts.

Crafting a compelling story is also crucial for successful investor pitching. Your story should highlight the problem you’re solving, how your solution is unique and innovative, and why it matters to your target customers.

By following these tips for creating a great pitch deck and delivering an engaging presentation with confidence tailored to each audience member’s interests, you’ll increase the chances of securing funding for your startup.

With a pitch deck you need to hit the following topics. Also check out pitch deck guideline below.

- The Product

- What does it do? Uniqueness. Invest in us. How does it work?

- The Problem

- Convince that something is broken

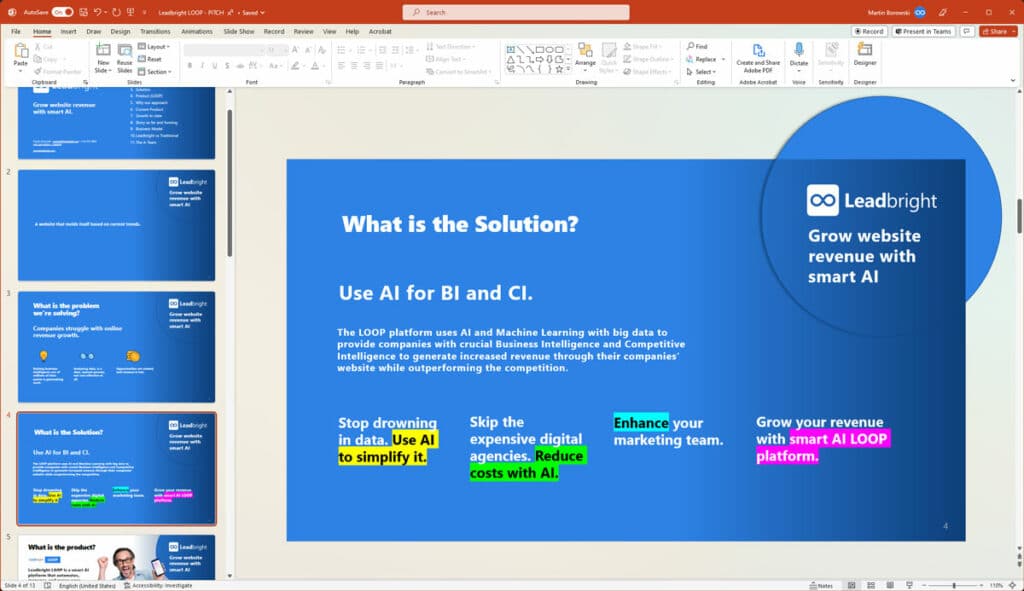

- The Solution

- Benefit. Problem solved.

- Growth to Date

- Be honest. Pre-seed? Seed?

- Business Model

- How do you plan on making money

- Creativity and Innovation

- What is special about YOUR product

- Financials

- Self-funded? Show budgets.

- Teams and Advisors

- List everyone you are involved it

- Summary

Try not to go over 10 slides. Here is a link to a pitch deck guideline in more detail. Credit goes to WebSummit/Collision Conference.

Ultimate Investor VC and Angel List:

Use Leadbright LOOP for revenue growth

Congratulations, you made is all way to the bottom! I hope you will have some fruitful and meaningful conversations with investors! Now it’s my turn to pitch! If you want to impress VCs and Angels further by showing amazing growth-to-date numbers, check out our revenue generation platform LOOP. We use AI to give you critical business and competetive intelligence to increase your growth numbers. Try our free trial now.

Summing up

And from here I’m signing off, creating a successful pitch deck and attracting investors requires careful planning and execution. There are many factors that go into making an effective pitch, so hope you’ve gathered some good tips from my guide and my VC and Angel list, which includes a over 700 investors links.

Startups Helping Startups ❤️